CONNECTED VISION

Future of satellite television

For all the discussion about the future of digital terrestrial television in the United Kingdom, there has been less consideration about what will happen about satellite television reception. However, time may be running out.

Unlike the debate about digital terrestrial television, the future of direct-to-home satellite distribution is determined by the availability of satellites and their orbital position.

For decades, geostationary satellites at 28.2°E and 28.5°E have delivered television to the United Kingdom. This orbital position is used for all Sky TV and Freesat services. The satellite dishes used to receive these services are all pointed at this particular spot in the sky.

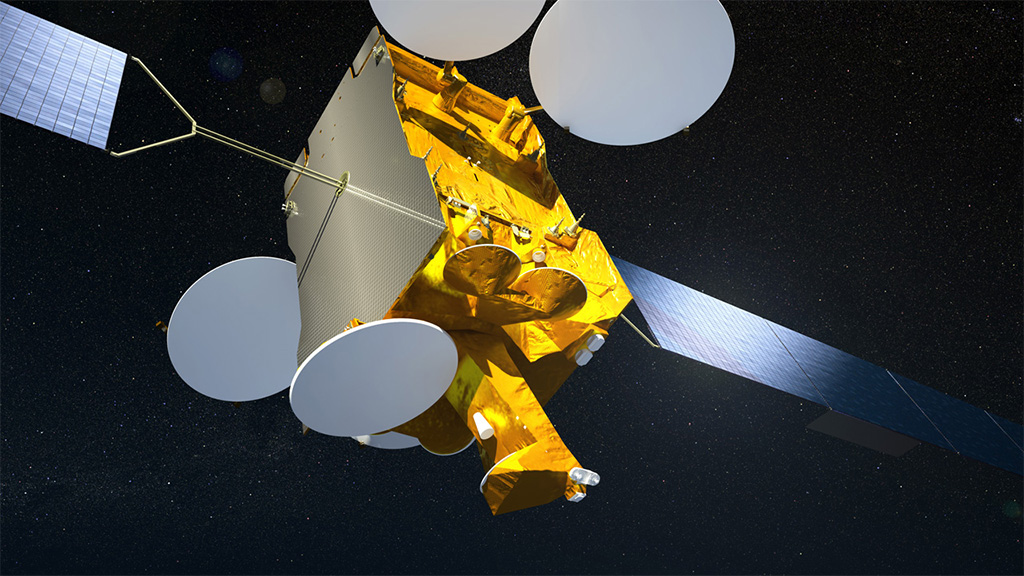

The main satellites currently involved, Astra 2E, Astra 2F, and Astra 2G, owned by SES, were launched between 2012 and 2014. With planned mission durations of 15 years, these spacecraft often exceed their design life by 2-3 years or more, but they are expected to reach end of life around 2030-2032.

One of the key factors is the amount of fuel available for station keeping within their orbital box of about plus or minus 0.15 degrees.

At the end of their operational lives, geostationary satellites they are generally repositioned out of the way in a graveyard or disposal orbit, a few hundred kilometres further out.

It is possible to reposition satellites from one orbital position to another, for instance from 19.2°E to 28.2°E, to repurpose them. However, that may not be a practical proposition.

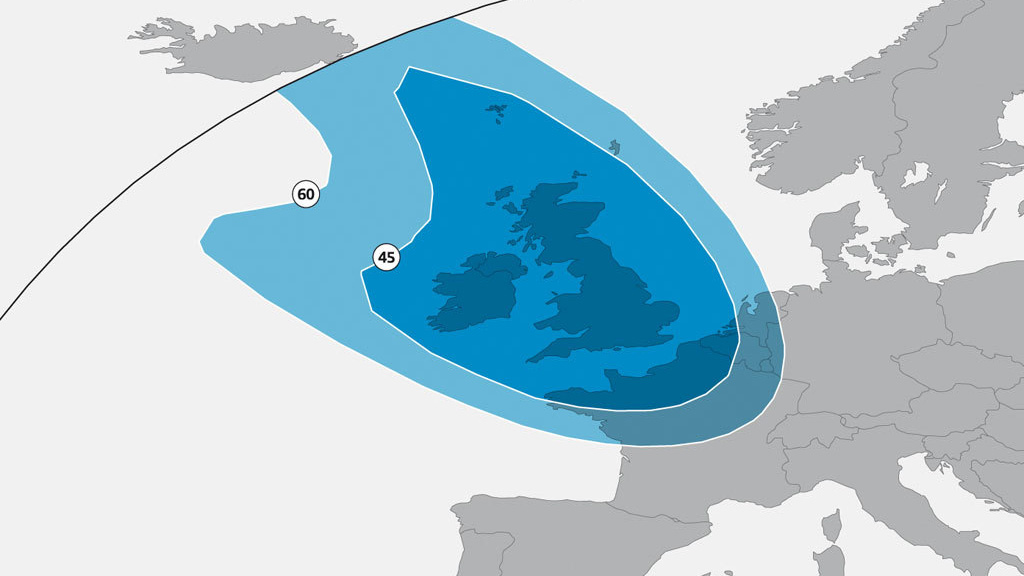

This constellation of Astra satellites at 28.2°E includes spot beams that are aimed specifically at the United Kingdom and the Republic of Ireland, which provides a degree of geographic limitation for free-to-air unencrypted services. This includes services for the BBC, ITV, Channel 4, and Channel 5.

The same spacecraft also carry transponders that serve other markets in across Europe, the Middle East, and West Africa. Between them, they serve over 40 million households, although the majority of these are delivered through cable or teleco television headends, with about 11.7 million relying on direct-to-home reception.

In the United Kingdom there are about 6 million Sky homes that use satellite and about 0.8 million that use Freesat. Over time, some of these may migrate to online options like Sky Stream and Freely, but one way or another, time is running out.

Replacing satellites is an expensive business, requiring an investment of hundreds of millions of pounds. It also takes time and is not without risk.

Although SES is far from dependent on British broadcasters for its business, strategic decisions about the future of television distribution will need to be taken soon.

In October 2024, Sky announced a major, long-term renewal with SES to continue broadcasting from 28.2°E and 28.5°E until 2029. Beyond that, the future seems uncertain.

British public service broadcasters would no doubt prefer not to pay for satellite distribution and instead have viewers pay their internet service providers to access their channels online.

One of the reasons is that satellite distribution requires multiple versions of a channel to serve different regions, either for regional news or different advertising markets.

The problem is that there is little incentive for consumers to switch from satellite to online. Internet services are already available to them for viewing on demand.

From a public policy perspective, satellite provides a reasonably reliable and relatively low-cost way of providing almost universal reception that is not dependent on internet infrastructure.

While the government would no doubt like everyone to be connected to a digital network, the scale of the challenge seems to be largely unrecognised, with an assumption that the market will address this.

18 months after launch, Freely celebrated a million active users over Christmas. So, it still has some way to go.

Television licence fees rise as numbers fall

The annual cost of a television licence in the United Kingdom is to rise by £5.50 to £180 in April. There will be a further inflation-linked increase the following year. An estimated one in eight households in the country with a television do not pay for the licence fee. The future funding of the BBC is a matter of debate, as its current charter expires at the end of 2027.

Although the television licence is collected on behalf of the BBC, one is required for any premises in the United Kingdom that watches or records any live television from any broadcaster. The licence requirement applies to live programmes on online platforms like YouTube, Netflix and Amazon.

A television licence is also required for the use of BBC iPlayer, although this is not currently enforced technically. The BBC says the household-address based licensing system does not match individual accounts.

Free licences are available to households with someone aged over 75 who receives pension credit and there is a 50% discount for those living with someone that is blind or severely sight impaired.

Bizarrely, you can still get a black and white television licence for £60.50, but it is not clear why. The last BBC accounts show there were about 3,000 monochrome licences issued.

The number of television licences in force has fallen to just 23.8 million, down 300,000 in a year and a fall of 2.4 million since its peak in 2018. The number of television licences has fallen every year since then, while the estimated number of television homes has continued to rise to over 27 million. It is estimated that about 12.5% or one in eight homes with a television does not pay the television licence.

In the last year, the BBC collected £3,843 million in licence fee income, a rise of £183 million over a year, mainly driven by the previous increase in the cost of a licence.

The cost of collecting the television licence has continued to rise to £166 million a year, up from £145 million in a year. Television licensing made 2 million visits to unlicensed homes in the last year, up by 50% on the previous year. The number of prosecutions has continued to fall, although most of them result in conviction. As reported by the Ministry of Justice, there were 28,542 prosecutions in 2024, down from 81,788 in 2020. Three quarters of prosecutions are of women. There were 25,006 fines imposed in 2024, down from 75,087 in 2020.

A recent report by the Public Accounts Committee said that the ground is shifting beneath the feet of the BBC, and that “without a modernised approach focused more on online viewing, the broadcaster will see faith in the licence fee system ebb away.”

The government says that the increase in the cost of the television licence, agreed as part of the last settlement in 2022, will help keep the BBC on a stable financial footing. It has committed to the licence fee for the rest of the charter period. It is considering the future funding of the BBC as part of the charter review, currently the subject of a public consultation, although it seems it has already ruled out paying for it though general taxation.

Six out of ten homes in UK have Netflix

18 million homes in the United Kingdom had access to Netflix at the end of 2025. That is over six out of ten homes. The number is up by 440,000 from 17.6 million the previous quarter, making it the third largest quarterly gain in recent years. Almost seven out of 10 homes in the country had access to an online video subscription service.

The quarterly establishment survey from audience measurement organisation Barb provides a barometer of service adoption. It shows that 20.6 million homes or 69.7% of households in the United Kingdom had access to an online video subscription service at the end of 2025. That is up slightly on 20.5 million the previous quarter.

18.0 million homes, or 60.9% of the country, had access to Netflix. 6.9 million of them, 23.3% of homes in the country, or 38% of Netflix homes, were on its advertising tier, up from 6.1 million the previous quarter.

13.8 million homes, 46.5% of all homes, had access to Amazon Prime Video, up from 13.6 million the previous quarter. 11.9 million of them, 40.3% of homes, were in its advertising tier. That is 40.3% of homes in the country.

7.6 million homes had access to Disney+, which is 25.8% of households, up slightly from 7.5 million the previous quarter. 2.6 million of them, of 8.8% of homes, were on its advertising tier, up from 2.3 million the previous quarter.

Paramount, Discovery+, and Apple TV+ also all saw increases in subscriptions, to 3.5 million, 3.4 million, and 3.0 million respectively. NOW from Sky was flat at 2.0 million homes.

It seems clear that online video subscriptions are not only a challenge to traditional broadcasters in terms of viewing, but a real threat in terms of advertising. While commercial television still has better overall national reach, Netflix and Amazon can potentially address 23% or 40% of the country respectively.

YouTube also represents a threat to commercial television advertising revenue. YouTube is keen for it to be viewed as a form of television but seems less keen to be measured as such.

Parent company Google says that Barb is in contravention of its agreements in the way it measures YouTube. Although the way that Barb chose to report YouTube viewing was somewhat selective, it did suggest that pre-school animation Peppa Pig was the most viewed ‘channel’ on YouTube.

Justin Sampson, who will step down as chief executive of Barb in 2026, once a replacement is appointed, has written that it is difficult to argue for equivalence in commercial and social impact while resisting equivalence in scrutiny.

“Some platforms argue they are now central to television viewing and should be treated accordingly,” he writes in The Media Leader. “Yet that claim carries an implied social and commercial responsibility: participation in the same independent, transparent measurement frameworks that underpin trust elsewhere in the market.”